osceola county property taxes due

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Osceola County Assessors Office Services.

Osceola County Property Appraiser Open Data

Enter an Address to Receive a Complete Property Report with Tax Assessments More.

. Yearly median tax in Osceola County. We enjoyed seeing everyone at the Silver Spurs Rodeo Parade in downtown City of St. Winter taxes are due by February 14 without penalty.

Osceola County Property Appraiser Katrina S. Ad Search County Records in Your State to Find the Property Tax on Any Address. In cases where the property owner pays through an escrow account the mortgage company should request and be sent the tax bill and the owner receives a copy of the notice.

First Half of Taxes DUE Septmeber 1st. Cloud Florida a couple of weeks ago. Scarborough CFA CCF MCF March 8 2022 507 pm.

Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The gross amount is due by March 31st of the following year. On average Osceola County residents pay about 348 of their yearly income on their property tax.

Welcome to Osceola County Iowa. Deadline to File for Exemptions. Receive 1 discount on payment of real estate and tangible personal property taxes.

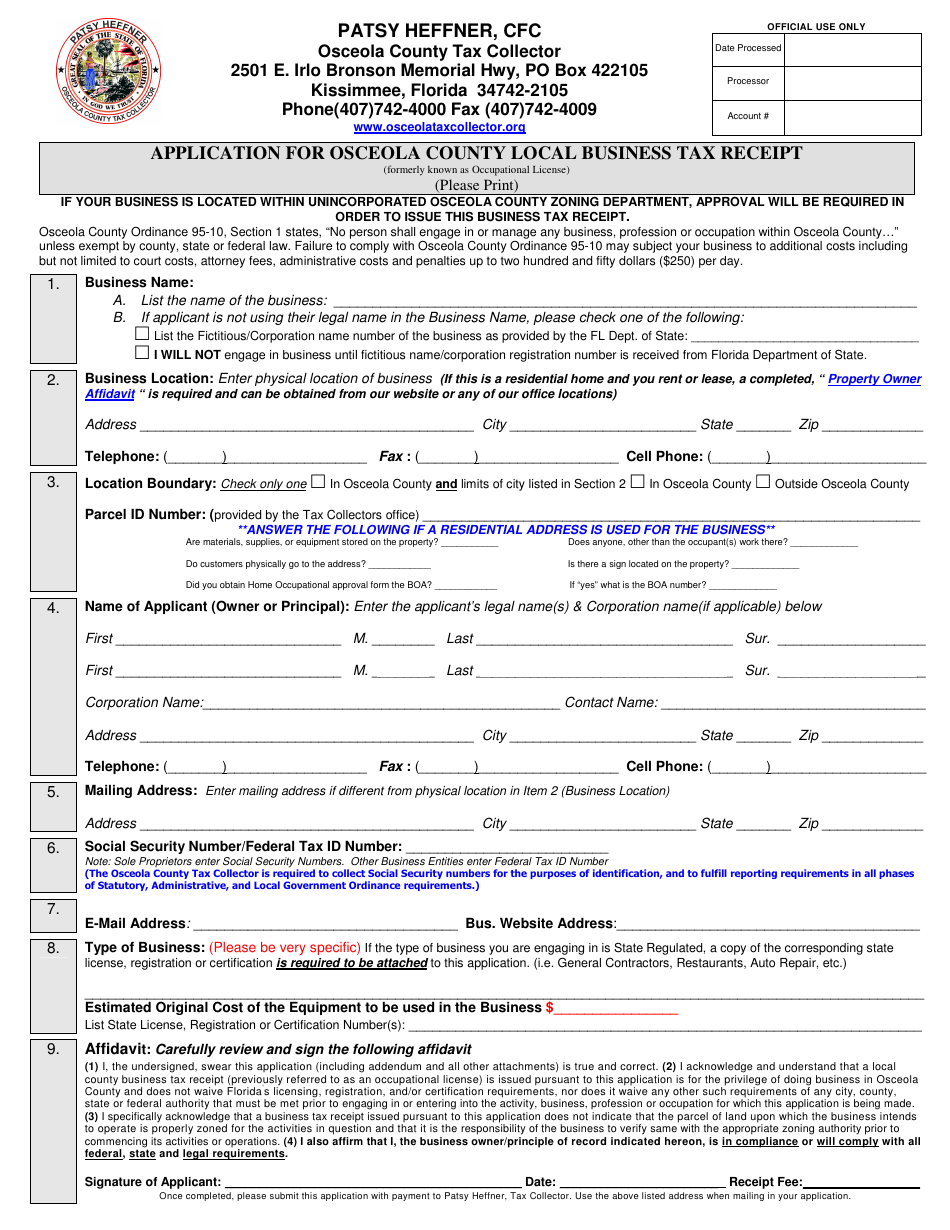

The Osceola County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Osceola County and may. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Receive a 3 discount on payment of real estate and tangible personal property taxes.

Township residents have the option of making partial payments on the taxes due for their property during the tax collection season. The Tax Collectors Office provides the following services. What is the due date for paying property taxes in Osceola county.

6 - PRIOR YEARS TAXES DUE DELINQUENT TAXS OWED. At least one field is required for the basic search not all fields must be filled in. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

If you dont pay by the due date you will be charged a penalty and interest. Osceola County Florida Property Search. Osceola Tax Collector Website.

My team and I love connecting with the community and look forward to future parades. 407 742 5000 Phone 407 742 4900Fax The Osceola County Tax Assessors Office is located in Kissimmee Florida. Learn all about Osceola County real estate tax.

Search Use the search critera below to begin searching for your record. Normally the deadline is the last day of the month but this time September 30th falls on a Saturday so you get until Monday October 2nd to pay this year. Iowa Property Taxes Are Due March 5 2018 - 1133 pm - Posted in News Northwest Iowa If you havent paid them yet you have about four weeks left to pay the final installment of 2017-18 property taxes in Iowa without having to pay a penalty.

Irlo Bronson Memorial Hwy. Enjoy online payment options for your convenience. Assessment Valuation End Date.

Property taxes are due on September 1. Get driving directions to this office. This service allows you to make a tax bill payment for a specific property within your Municipality.

Full amount due on property taxes by March 31st. If prior years taxes are unpaid a message will appear on your bill stating PRIOR YEARS TAXES DUE. Tax statements are normally mailed out on or before November 1st of each year.

Taxes were actually due on September 1st but may be paid without penalty by October 2nd. When paying property taxes by parcel number please enter the 10 digit parcel number which appears in the bottom right corner of either payment stub. Tangible Personal Property Returns Due.

Local Business Tax Receipts become delinquent October 1st and late fee applies. On February 28 2022 will be turned over to the Livingston County Treasurer as delinquent. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143.

The delinquent amount is not reflected on this notice and must be paid with guaranteed funds. All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest. Please correct the errors and try again.

An owner of eligible property may file a completed summer property tax deferment form with his or her city or township treasurer before September 15th or before the date your summer taxes. Property Appraisers Office immediately at 407-742-5000. Call 407 742-4000 for amount due.

Welcome to the Tax Online Payment Service. Summer taxes are due by September 14 without interest. Discover Mastercard Visa and e-Check are accepted for Internet Transactions.

Any and all taxes left unpaid or payments received after 500 pm. Property Appraiser Important Dates. Osceola County has relatively high median property taxes with the property tax being around 095 of the propertys assessed fair market value.

Pin By Michele Mehnert On Homebuying Business Tax Property Tax Home Buying

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Contact Us School District Of Osceola County

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

3318 Cat Brier Trl Harmony Fl 34773 In 2021 Apartments For Rent Apartment Harmony

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

Osceola County Florida Property Search And Interactive Gis Map

Property Search Osceola County Property Appraiser

Curriculum Amp Instruction Consent Agenda Osceola County School